Understanding Portfolio Health Indicators

Much like a car limping along the slow lane, retirees must be vigilant about their investment portfolios. A safe withdrawal rate is pivotal for ensuring that your money lasts throughout retirement. Just as a vehicle sends signals when it's in trouble, portfolio health indicators can alert retirees to potential pitfalls.

The Importance of the Safe Withdrawal Rate

The safe withdrawal rate—the percentage of your portfolio that you can take out annually without running out of funds—is crucial. Most guidance suggests a conservative figure, commonly around 4%, but this can vary based on market conditions, lifestyle changes, and personal financial goals.

Indicators That Signal Liquidation Risk

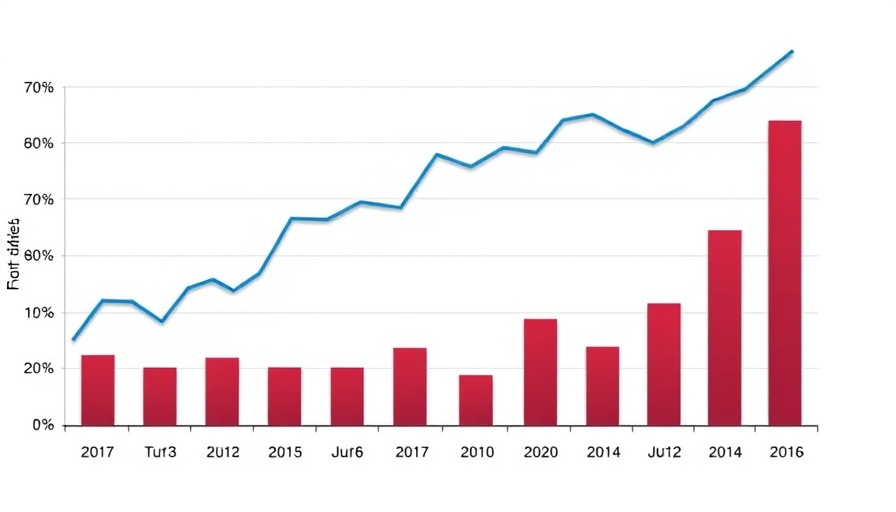

Retirees should monitor several signs that may indicate trouble ahead. For instance, if the returns on investments consistently lag below inflation or if withdrawal rates begin to exceed investment gains, it could be a warning sign that action must be taken. Maintaining a close eye on these indicators can help adapt withdrawal strategies accordingly.

Shifting Market Conditions

Moreover, shifts in the economy can impact how much one can safely withdraw. During bear markets or economic downturns, adjusting your withdrawal plan is critical. Advisors recommend dynamic asset allocation—revising your investment strategy based on both progress made and market health—which can prove beneficial.

Conclusion: Be Proactive

A proactive approach to managing your withdrawal strategies can help stave off potential financial turmoil. Regular assessments of your portfolio's health and being willing to make necessary adjustments can ensure sustainability in your retirement funds. Don't leave it to chance; define what the safe withdrawal rate means for you and act accordingly.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment