Understanding the Safe Withdrawal Rate: A Balancing Act

In the realm of retirement funding, the concept of a safe withdrawal rate (SWR) holds significant weight. While many plan their financial futures around a universally accepted 4% rule, data specific to the UK presents a sobering alternative: a mere 3.1% for those looking at a 30-year span. The stark difference begs the question—how does one navigate these varying perceptions to ensure sustainable financial freedom?

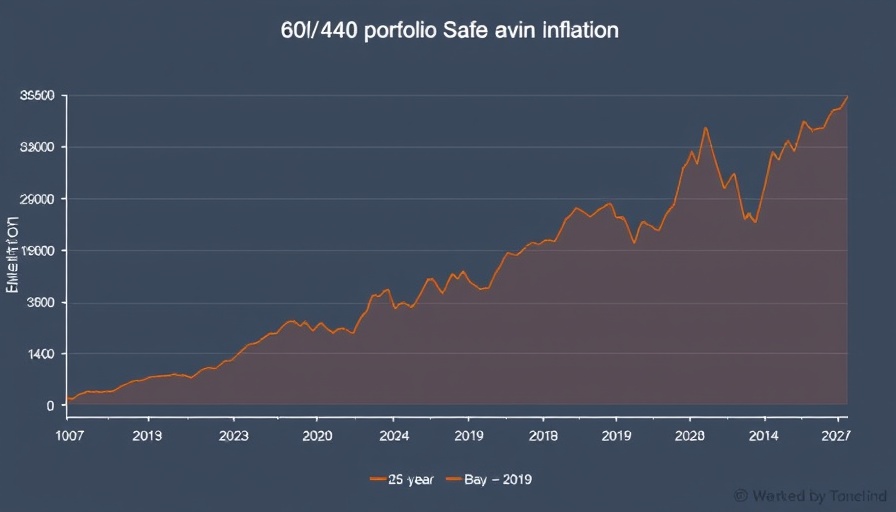

Historical Lessons: The 60/40 Portfolio

A review of 155 years of performance data for the 60/40 portfolio—a mix of 60% equities and 40% bonds—reveals that for over 88% of historical scenarios, a 4% withdrawal was attainable. This statistic gives hope for current retirees, yet it does not absolve them from the lurking dangers of potential portfolio depletion.

Innovative Tracking for Real-Time Planning

Planning must evolve; while historical measures provide a framework, retirees today benefit from real-time analytics. Tools that assess portfolio health continuously can mitigate anxiety, offering reassurance that their financial path is sound. This proactive approach allows retirees to adjust withdrawals based on market performance rather than relying solely on historical norms.

A Closer Look at Bad Withdrawal Scenarios

It’s valuable to recognize common factors among retirees who fell below the 4% threshold. Those who retired in economically tumultuous periods—like 1917 or the post-World War II era—demonstrate that reliance on a static SWR can be shortsighted. Diligent financial management during drawdown years, perhaps through more adaptable withdrawal strategies, could certainly change outcomes.

Embrace Simplicity: Finding a Sweet Spot

The volatility of financial markets often discourages complex withdrawal strategies, leading many retirees to favor simpler, rule-of-thumb heuristics. By understanding their portfolio’s dynamics, retirees can adopt flexible spending strategies that balance comfort with financial prudence, allowing for spontaneous moments without jeopardizing their long-term sustainability.

In conclusion, navigating the retirement waters requires a balance between using historical data and embracing innovative tools and strategies. This holistic understanding can empower both individual retirees and financial institutions in providing tailored services that adapt to current economic climates.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment