General Fusion’s Uncertain Future amidst Layoffs

In a significant shift for one of Canada’s promising startups, General Fusion has laid off at least 25% of its workforce, coinciding with a crucial milestone for its innovative LM26 fusion demonstration device. Despite achieving a notable technological breakthrough by successfully compressing plasma— a necessary condition for fusion—the company faces an urgent financial crisis. CEO Greg Twiney highlighted in an open letter the current difficulties in securing funding: "today’s funding landscape is more challenging than ever as investors and governments navigate a rapidly shifting and uncertain political and market climate." With a history dating back 23 years, General Fusion has raised approximately $440 million to date and counts high-profile investors, including Jeff Bezos.

The Broader Challenges Facing the Fusion Industry

The constricted funding situation for General Fusion epitomizes the larger hurdles plaguing the fusion sector. Although it has garnered significant investment, this amount pales in comparison to competitors such as Commonwealth Fusion Systems, which has raised over $2 billion, and Helion, with exceeding $1 billion. With only one reactor achieving scientific breakeven— a historical, yet non-commercial milestone— this highlights the expensive and drawn-out path to achieving a commercially viable fusion reactor.

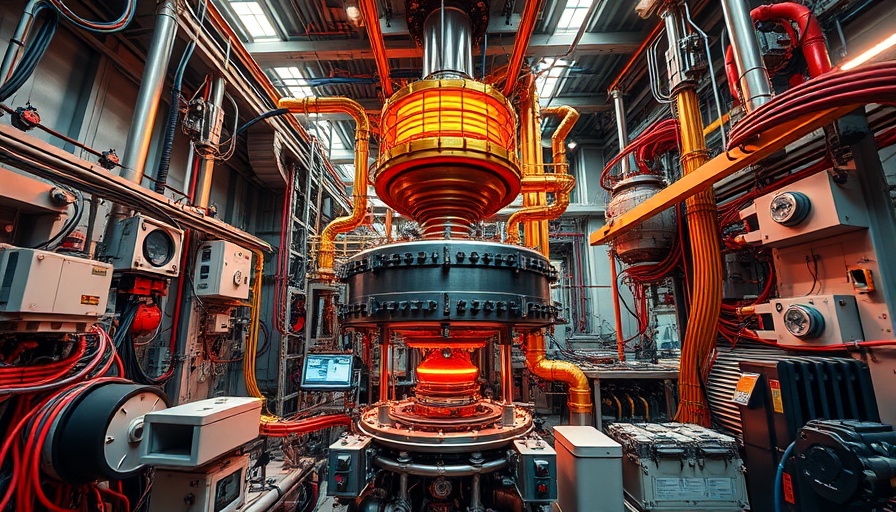

General Fusion’s Unique Approach

Unlike many other fusion startups that focus on either magnetic or inertial confinement methods, General Fusion is attempting to use steam-driven pistons to compress fuel. This unconventional strategy, reminiscent of past efforts by the U.S. Navy in the 1970s, faces skepticism since it has not yet demonstrated viability. However, proponents believe that advancements in technology could resolve previous challenges faced by similar systems. Success in this area would not only prove General Fusion's method but could also redefine expectations for fusion energy generation.

Implications for Investors and the Future of Fusion Energy

The layoffs at General Fusion serve as a wake-up call for investors and stakeholders in the fusion energy landscape. Success in achieving commercial breakeven remains elusive, and with increasing costs, companies must navigate the turbulent waters of funding to secure their future. Investors should remain vigilant, as the impacts of such layoffs resonate beyond the immediate loss of jobs, potentially stalling the progress of research and innovation in an already fragile sector.

General Fusion’s need for rapid financial solutions underscores the urgency within the fusion industry—a space with lofty hopes that are yet to materialize on a commercial scale. In a sector built on aspirations of transformative energy solutions, laying off talent raises questions about the pace and sustainability of advancements in fusion technology.

Add Row

Add Row  Add

Add

Write A Comment