Understanding Asset Classes: A Foundation for Smart Investing

In the intricate world of investing, the backbone of a robust portfolio often lies in a well-structured asset allocation strategy. Just like an alchemist seeks the perfect combination of elements for transformation, investors must navigate various asset classes to weather financial storms and ultimately achieve financial independence.

The Core Asset Classes You Should Know

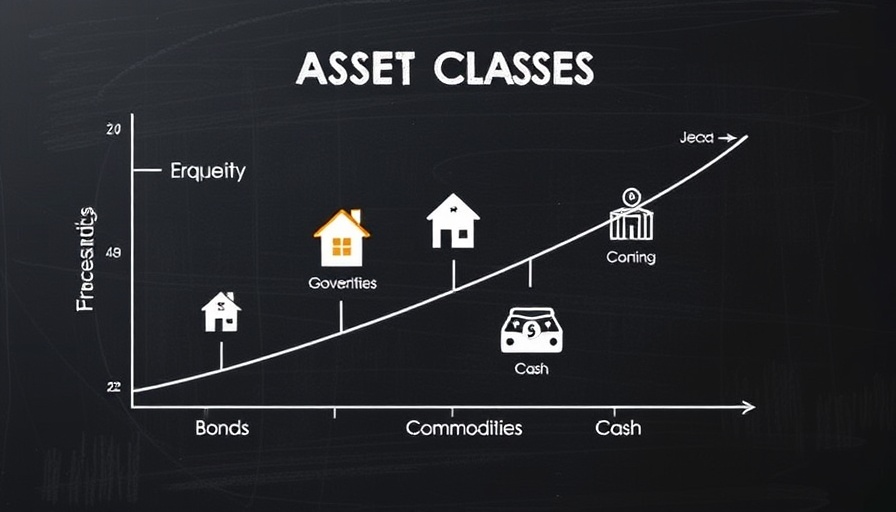

As a financial institution or service provider, possessing knowledge about essential asset classes is invaluable. The main asset classes include cash, bonds, equities, alternative investments, and real estate. Each provides unique benefits and challenges that influence long-term financial goals.

Cash: The Starting Point

Cash is perhaps the most straightforward asset class. It offers liquidity, allowing quick access to funds when needed, which can be critical in emergencies, such as job loss. Available data illustrates that while cash can withstand market crashes relatively well, it suffers from inflation in the long term. For instance, £100 could be worth approximately £74 in a decade without attractive interest rates to counter inflation. Thus, cash should only form a small part of a diversified investment strategy.

Why Bonds Matter

Bonds present a more nuanced investment opportunity. These instruments serve as I.O.U.s from entities like corporations or governments, providing interest payments while returning the principal at maturity. When considering passive investing, focusing on high-quality government bonds can significantly reduce default risk, making them a cornerstone for stability. A sound approach recommends limiting exposure to investment-grade bonds—those rated AA- or higher.

Tips for Service Providers to Educate Clients

In serving clients, financial institutions can facilitate informed decision-making by emphasizing the importance of diversification across these asset classes. A comprehensive understanding enables investors to better align their portfolios with risk tolerance and time horizons. A balanced approach incorporating equity and alternative investments can also enhance returns and mitigate risk during different market conditions.

Conclusion: Equip Clients for Financial Success

Understanding asset classes not only bolsters an institution's credibility but serves as a pivotal communication point with clients. This holistic approach can provide clients with powerful insights, equipping them to build resilient investment portfolios and pursue their financial aspirations confidently.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment