Navigating Risk Amidst Extreme Market Valuations

As we approach the end of 2025, the U.S. stock market has become a subject of significant concern for investors, particularly for financial institutions and service providers. With current valuations reaching historic highs, experts warn of the potential ramifications.

Understanding Market Valuation Metrics

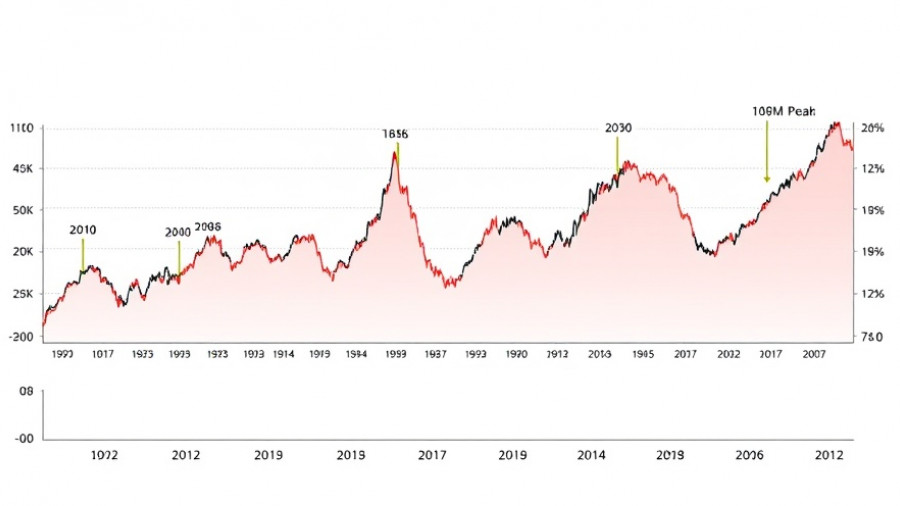

Prominent indicators like the Buffett Indicator, which measures market capitalization against GDP, suggest that the market is overvalued by approximately 220%—a level unseen since 1929. Similarly, the CAPE ratio, which smooths corporate earnings over ten years, indicates that investors are paying far more for stocks than they should be, signaling that correction may be on the horizon.

The Historical Context of Market Extremes

To understand the current landscape, it’s crucial to reflect on past market bubbles. The collapse following the 1929 stock market crash serves as a reminder that such extreme evaluations often precede significant downturns. With many investors recalling the dot-com bust and the 2008 financial crisis, there is a palpable anxiety surrounding today’s market conditions.

Strategies for Investors: Navigating Uncertainty

For institutions preparing for potential fallout, advice from financial advisors becomes paramount. Proactive measures include re-evaluating portfolios, considering strategic reallocation from overvalued U.S. stocks to more attractive investments in undervalued markets, particularly in emerging economies. Additionally, dollar-cost averaging can mitigate the fear of plunging into the market all at once.

Communicating With Clients: Educating for Confidence

Amidst the uncertainty, financial institutions must prioritize transparency and communication with their clients. Providing educational resources that explain current market dynamics and available strategies can bolster investor confidence during challenging times. Clients who feel informed are more likely to withstand market volatility without panicking.

As the market teeters on the edge of potential correction, staying informed and adopting strategic approaches can provide financial institutions a firm footing in these turbulent waters.

Add Row

Add Row  Add

Add

Write A Comment