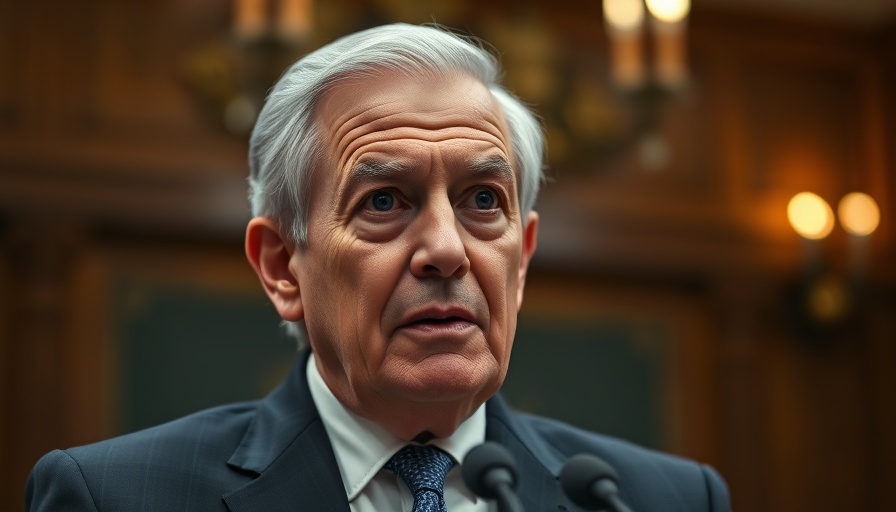

Truss’ Bold Declaration: The Push for Political Control of Interest Rates

In a striking statement, former Prime Minister Liz Truss has called for a reevaluation of how the Bank of England (BoE) operates, suggesting that politicians should have more control over setting interest rates. Citing the potential for a 'reckoning' within the institution, Truss argues that the current approach is insufficiently accountable to the political process and ultimately detrimental to economic stability.

A Shift in Responsibility: What This Means for Financial Institutions

Truss's position reinforces a growing concern among financial institutions that the BoE's autonomy may not be serving the public interest adequately, particularly as inflation rates remain stubbornly high. Control over the base rate has historically been a critical tool for managing economic fluctuations, and Truss suggests that this authority should rest in the hands of elected officials who are directly accountable to the public.

Why Now? The Current Economic Climate

The backdrop of this debate is the UK's pressing inflation crisis, which continues to affect everything from household budgets to corporate strategies. With inflation predictions fluctuating, financial service providers must navigate an uncertain terrain, making it increasingly important to understand who holds the reins of monetary policy. The idea of politicians influencing interest rates is not new, but the suggestion comes at a time when the public's confidence in the BoE has been shaken.

Considerations for the Future: Benefits and Pitfalls

Advocates of Truss’s proposal see it as a pathway to greater accountability, arguing that a direct link between political will and monetary policy could foster economic strategies more aligned with public needs. Conversely, critics worry that merging politics with monetary policy could lead to short-sighted decisions driven by election cycles rather than long-term economic stability.

Final Thoughts: The Risk of Political Influence

As discussions continue, stakeholders in the financial sector must remain vigilant. The balance between independence and accountability is critical. Understanding this evolving landscape is essential for making strategic decisions in investments, lending practices, and overall financial planning.

Add Row

Add Row  Add

Add

Write A Comment