Pexa's Appointment Marks a New Era for Amity Law

Amity Law recently announced the appointment of Pexa as its third-party managed account (TPMA) provider, positioning itself at the forefront of digital transformation in the conveyancing sector. Following approval from the Council for Licensed Conveyancers (CLC), this strategic partnership ushers in a wave of innovation as Pexa prepares to launch its sale and purchase services in conjunction with a revolutionary digital property exchange for remortgages.

Strengthening Security and Efficiency in Transactions

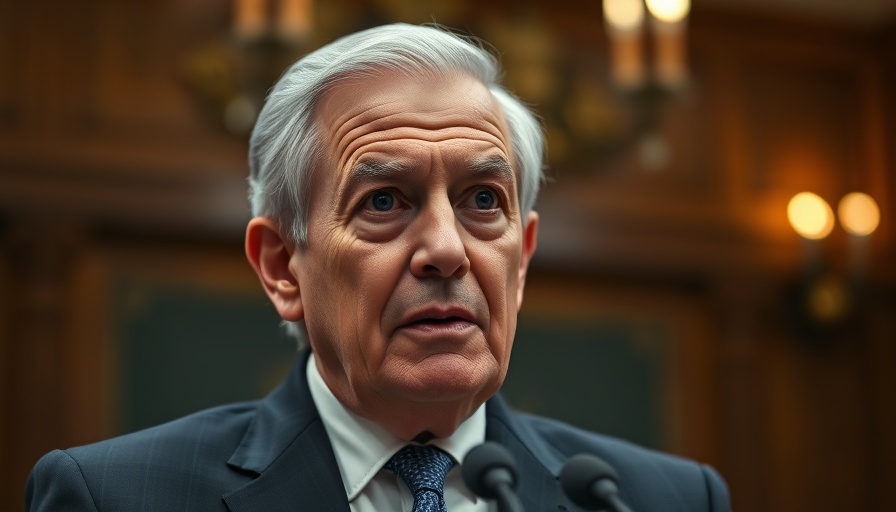

With the approval from the FCA as an authorized payment institution, Pexa is equipped to manage client funds on behalf of Amity Law, paving the way for automated settlements and streamlined title lodgements. UK CEO Joe Pepper emphasized that this advancement establishes a precedent in the market, showcasing Pexa’s commitment to security and compliance. “We are excited to help drive momentum in the UK property market,” he noted, highlighting the significance of this launch.

A Game-Changer for the Home Buying Process

For Amity Law, the collaboration signals a transformative step towards enhancing client experience. Sarah Ryan, head of legal practice at Amity Law, described Pexa’s role as a game-changer in reducing fraud risks and creating a safer, clearer process for borrowers. With these developments, the traditional home buying anxieties may soon become a relic of the past. Enhanced transparency and efficiency are not just industry buzzwords; they represent a tangible improvement in how home buyers engage with the market.

What This Means for the Future of Conveyancing

The digitalization of property transactions is more than mere innovation; it’s a fundamental shift poised to reshape the landscape of buying and selling homes. Jason Hinrichsen of CLC reaffirmed the importance of TPMA companies, stating that they can provide the necessary security and transparency to benefit all stakeholders in home transactions.

As Pexa prepares for its full product launch in the coming months, the real estate and financial sectors will be watching closely to see how these changes will affect home buying dynamics and improve overall market trust.

Add Row

Add Row  Add

Add

Write A Comment